Digital Banking Upgrade for Business Accounts

Steps for a Smooth Transition

Quick-Start User Guides: Coming Soon

We’re upgrading your digital banking tools—and building resources to match. Whether you’re managing payments, users, or accounts, you’ll find everything you need right here to get up to speed quickly and make the most of the new platform.

Whether you’re overseeing daily operations or preparing for a smooth transition, these step-by-step resources are designed to make it easy to get up and running with confidence.

First Time Login for Business Admin Users

First Time Login for Business Sub Users

Business Admin Users Guide

Checklist for Business Users

QuickBooks Reconnect Guide (Desktop)

QuickBooks Reconnect Guide (Online)

FAQs

Need help navigating the upgrade? You’re in the right place. Browse the topics below to find answers organized by category—so you can quickly access the information that matters most to you.

Topics include:

Whether you’re just getting started or looking to explore new capabilities, these FAQs are here to guide you every step of the way.

About the Upgrade

When Is the Upgrade Happening?

The upgrade will be available on Tuesday, October 21, 2025. Get ready for a smoother, smarter digital banking experience!

Why Did BankCherokee Upgrade Digital Banking?

To give you more control, stronger security, and a better overall experience—tailored to how you bank today.

What Are the Improvements on This Platform?

You’ll notice:

- A modern, user-friendly design

- Improved navigation for faster access

- Enhanced mobile access for banking on the go

- Expanded tools to help you manage finances more efficiently across all devices

What New Features Are Available?

The upgraded platform includes:

- Enhanced alerts and notifications to keep you informed

- A customizable dashboard that fits your preferences

- A unified experience for both personal and business users—no need to switch platforms

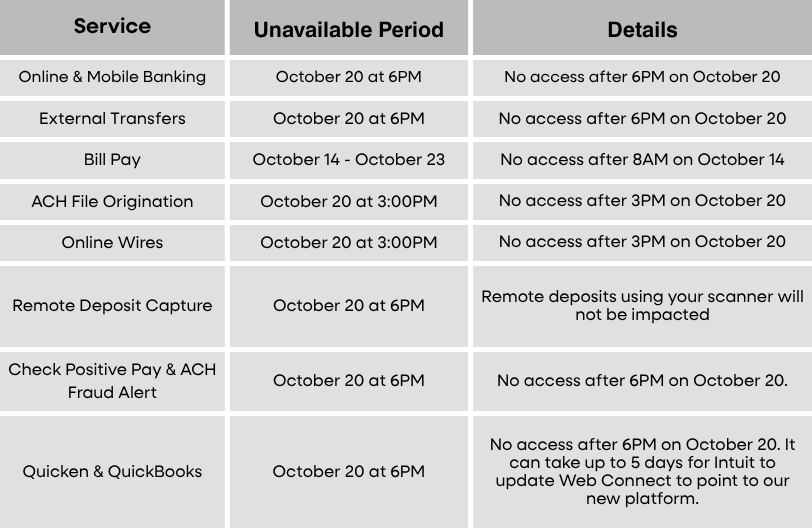

Will There Be Any Interruptions to My Current Online Banking Account?

Yes—just before we go live with the new digital banking platform, some features will be temporarily paused. You’ll still be able to view your accounts, but transfers, payments, and deposits won’t be available for a short time. Full access will resume on October 21.

Service Interruption Chart – Updated October 9, 2025

We’ve recently updated our Service Interruption Chart to provide you with the most accurate and up-to-date information. Thank you for your patience as we continue to improve your experience.

First Time Login

Do I Need to Re-Register?

No. Re-registration is not required. If you were enrolled in BankCherokee’s digital banking before Tuesday, October 21, 2025, you’ll automatically have access to the new platform. Just have your Account number and EIN or TIN ready—you’ll need it for your first login.

Did My Login Credentials Change?

Your username and password will remain the same. If you’re unsure of your credentials, feel free to call us at 651-291-6240—we’re happy to help!

Will Face ID or Touch ID Still Work?

Yes, but you’ll need to log in manually the first time. After that, you can re-enable biometric login in your settings.

What Devices Are Supported?

The new app is compatible with most Apple and Android devices. For the best experience, we recommend updating your device to the latest operating system version.

Mobile App

Do I Need to Download a New Mobile App?

- Apple users: You’ll need to delete the old app and download the new version from the App Store.

- Android users: You’ll need to delete the old app and download the new version from the Google Play Store.

Will the Old App Still Work?

No. Once the new app launches, the previous version will no longer be supported and will not function.

What Version of My Phone’s OS Is Required?

The new app supports most modern iOS and Android operating systems. For optimal performance and security, we recommend updating your device to the latest available version.

Tools & Features

Is the Look and Feel of the New Platform Different?

Yes. We’ve introduced a modern, intuitive design to help you easily navigate your accounts, track spending, and manage transfers—all from one streamlined dashboard.

Can I Still Transfer Money Between Accounts or to Other People?

Absolutely.

- Internal transfers between your BankCherokee accounts—or to another BankCherokee customer—are available and now even more seamless.

- External transfers continue to be supported for customers enrolled in ACH Origination, providing flexibility to move funds wherever needed.

How Do I Pay Bills in the New System?

Our upgraded Bill Pay experience allows you to:

- Manage your payees

- Set up one-time or recurring payments

- View your payment history—all within the new platform

Will I Need to Re-Enroll in eStatements?

No. If you were previously enrolled in eStatements, you’ll continue receiving them automatically—no action needed.

Will My Scheduled Transfers Carry Over?

No. As part of the upgrade, Recurring Scheduled Transfers will not carry over automatically. You’ll need to reestablish them manually within the new platform to ensure your transfers continue as expected.

Can I Still Use Mobile Banking?

Yes. The new mobile app mirrors the functionality of online banking and introduces new features like:

- Improved mobile check deposit

- Enhanced security features

Make sure you’re using the updated app. For more details, see the FAQs regarding the mobile app.

Will My Existing Business Bill Pay Activity Transfer?

Yes. Your active payments and payees will be migrated. As a best practice, we recommend verifying recent activity to ensure everything is accurate.

Have More Questions?

We know change can feel overwhelming, but you’re not on your own. Our team is ready to guide you every step of the way. Reach out anytime, and we’ll make sure your transition is smooth and stress-free.